Jack Monroe in one corner, the Don’t Pay campaign in the other…

You may have heard various leftfield approaches to rising bills in the UK, from advisors on TV to radicals online advising you what to do (or not do) in the face of huge energy bills.

Can you simply refuse to pay? Or can you take a less radical approach?

FIRST STEPS

First off, TALK to your energy supplier. Can they help by putting you on a fairer payment scheme? Most suppliers want some kind of regular payment from their customers but if they’re aware of your trouble paying the amount you’ve been set, they may just want to see how much you are able to pay.

Change Your Supplier

Changing your energy supplier is the next step, if your current one won’t play ball. The Super Smart Energy Savers Report is worth reading: it was set up earlier this year to provide options for people having trouble paying their energy bills, and MoneyMagpie have a great comparison tool here.

JACK MONROE

Anti-poverty campaigner Jack Monroe has been quoted as advising those having trouble changing their energy supplier to set up a standing order for an amount they can afford, instead of their current direct debit.

“They won’t like it but… they won’t be able to change the amount on a standing order like they can on direct debit. It puts YOU back in control. If they use threatening/bullying tactics to try to intimidate you into changing it back or paying more, make a complaint to the Ombudsman. For every complaint they receive, the energy co gets fined around £375. They’d have no qualms about fining you. Hit them where it hurts them.”

The mass media are reporting that the average UK household may experience an energy bill rise of up to £4000, with many saying they can’t afford the price increase. Some are already paying nearly £400 per bill.

DON’T PAY

More radically, over 100,000 people have signed up to the Don’t Pay campaign, which started in June and which claims: “It’s a simple idea: We demand the Government scrap the energy price rises and deliver affordable energy for all. We will build a million pledges and by October 1 if the Government and energy companies fail to act we will cancel our direct debits.”

“Even if a fraction of those of us who are paying by direct debit stop our payments, it will be enough to put energy companies in serious trouble, and they know this. We want to bring them to the table and force them to end this crisis.”

THE COUNTER-ARGUMENT

Jack Monroe, however, does NOT necessarily think this is a great idea because, she says, “if your energy company won’t let you change your direct debit, you can cancel it. Note down the banking details and reference number and set up a standing order for the amount you ACTUALLY use/can afford instead.”

Monroe goes on to say that you should carefully check the terms and conditions of your agreement with your energy company. She also directs people on prepay meters to claim benefits and support available to them, directing them to the Fuel Bank website.

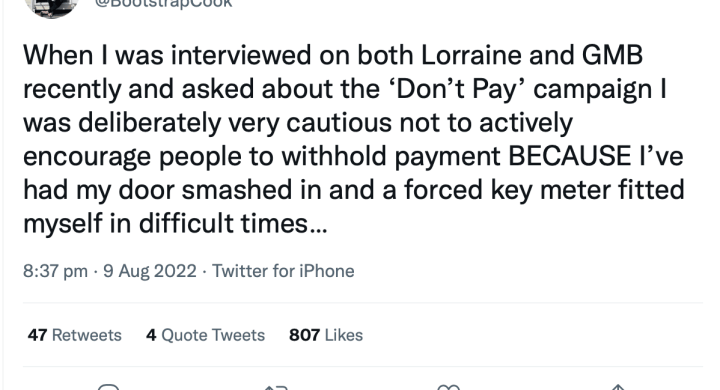

Her final word on the Don’t Pay scheme is this: “When I was interviewed on both Lorraine and GMB recently and asked about the ‘Don’t Pay’ campaign, I was deliberately very cautious not to actively encourage people to withhold payment BECAUSE I’ve had my door smashed in and a forced key meter fitted myself in difficult times.

My credit rating is STILL recovering from CCJs from that period, so the LAST thing I would do is to advise people to take any action that might lead to similar consequences.”

Jasmine Birtle’s Says

“I’m very wary of the Don’t Pay campaign and I think that anyone considering simply not paying should consider the potential consequences. Energy bills are ‘priority payments’ and not paying them, or not even trying to negotiate with your energy provider, can seriously damage your credit rating. The energy companies can pass your debt on to debt collection agencies which, as Jack Monroe mentions, can involve quit unpleasant run-ins with bailiffs.

“It really is better to speak first to your energy provider – many have charitable funds that they can use to help – and also speaking to one of the free debt advice charities like StepChange, Citizen’s Advice and Community Money Advice as they also may be able to point you in the direction of extra help. Speak to your local Council too as they can often help if you haven’t qualified for benefits or other help.”